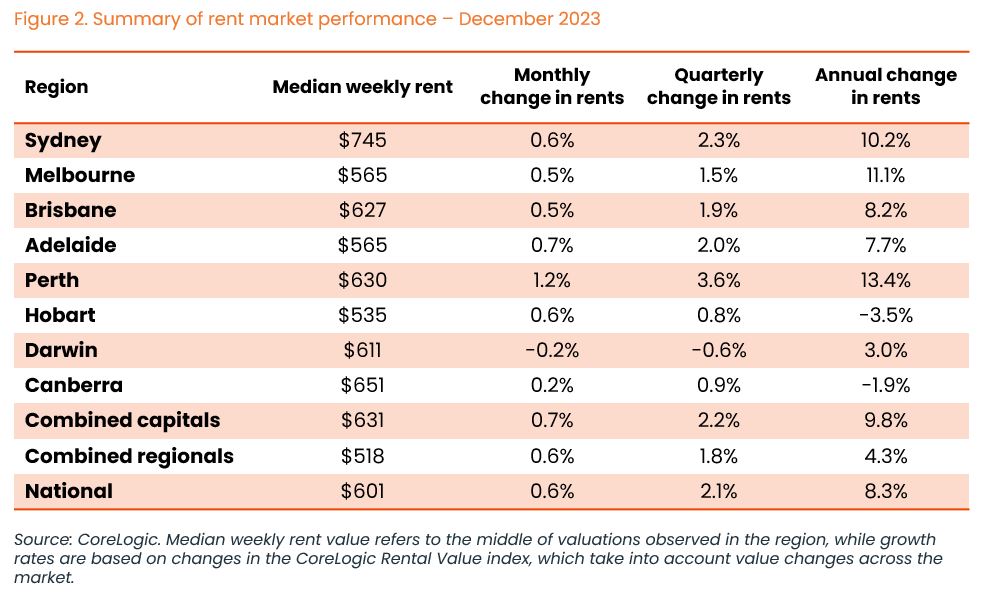

At a glance:

- CoreLogic has released its first Quarterly Rental Review for 2019, showing rents have risen by 1 per cent during the first three months of this year.

- Sydney is the most expensive capital city to rent with a median weekly rent of $582 per week, while Perth is the cheapest at $385.

- Quarterly rents have increased across all capital cities, bar Darwin and Sydney.

The first CoreLogic Quarterly Rental Review for 2019, which tracks median rents and rental yields across Australia, shows that national weekly rents have risen by 1 per cent during the first three months of the year.

“This seasonally strong first quarter has delivered the highest increase in weekly rents since the corresponding first quarter a year ago”, says Cameron Kusher, Research Analyst for CoreLogic. “Our regional housing markets are performing marginally better than the capital cities, many of which have been experiencing weaker rental market conditions in recent years due to excess housing supply and growing investor activity.”

“Quarterly rents have increased across all capital cities, bar Sydney and Darwin. Hobart is experiencing notable growth, with rents increasing by 3.6 per cent over the past quarter. However, with a median rent of $582 per week, Sydney remains Australia’s most expensive city for tenants by far.”

The Quarterly Rental Review also highlights a national increase in yields over the past three and 12 months. Gross rental yields for the first quarter are 4.10 per cent compared to 3.95 per cent in the previous quarter and 3.77 per cent a year ago. Darwin has the highest rental yield across the country with an annual median of 6 per cent.

Key findings – rents and yields

- Nationally, rents increased by +1 per cent over the March quarter and by 0.4 per cent over the past 12 months. Combined capital city rents were 0.9 per cent higher than the December 2018 quarter but -0.1 per cent lower than the previous March quarter. This is the lowest annual change since CoreLogic started tracking rents in 2005. Regional rents were slightly stronger, with a 1.1 per cent increase over the quarter and a 1.8 per cent increase over the past year.

- In the first quarter, rents climbed in all capital cities except for Darwin (-0.3 per cent). Hobart was by far the strongest performer, with a 3.6 per cent increase in rent over the past quarter, followed by Perth (+1.8 per cent) and Canberra (+1.5 per cent). Hobart also experienced the highest increase in rent over the past 12 months (+5.4 per cent) while at the other end of the scale the media rent in Darwin fell by -5.7 per cent.

- Nationally, the median rent is $436 per week. The median rent across the capital cities is $465 per week, and $378 per week across the regionals.

- Gross rental yields have increased from 3.8 per cent to 4.1 per cent nationally. Across the combined capitals, the average rental yield is 3.8 per cent (up from 3.5 per cent). Regional yields are far higher at 5.1 per cent, up from 4.9 per cent 12 months ago.

Key findings – capital cities

- Sydney remains Australia’s most expensive capital city market, with a median weekly rent of $582, despite a decline of -3.1 per cent over the past 12 months. While rents in Sydney remained the same as the previous month, they increased by 0.5 per cent over the past quarter. Sydney also has the lowest rental yields out of all capital cities, at 3.5 per cent over the past quarter.

- Canberra reports a median rental cost of $550 per week, an increase of 1.5 per cent over the past quarter and 3.6 per cent over the past 12 months. Canberra is one of only two capital cities (alongside Darwin) to experience a drop in weekly rent over the past month (-0.1 per cent).

- In Melbourne, rents are $454 a week – an increase of 1 per cent over the quarter and 2.1 per cent over the past 12 months. Melbourne also reported the greatest increase in rental yields out of all capital cities, with current rental yields being 3.6 per cent, compared to 3.1 per cent a year ago. Despite the rise in yields, Melbourne has the second lowest weekly rental yield out of all capital cities (after Sydney).

- Brisbane rents are starting to climb again, with Brisbane now having a median weekly rent of $436.This is an increase of 0.8 per cent over the past quarter, and 1.4 per cent over the past 12 months.

- Perth is the most affordable capital city to rent in with a median weekly rent of $385. However, it is showing signs of growth, achieving the second highest quarterly rate (after Hobart) with an increase of 1.8 per cent over the past 3 months. Over the past year, Perth rents have increased by 2.1 per cent.

- Adelaide closely follows Perth to become the second most affordable capital city to rent a property in, with a median weekly rent of $386. Like Brisbane, it experienced a 0.8 per cent rise in rents over the March quarter. Over the past 12 months, rents in Adelaide have risen by 1.2 per cent. Gross rental yields have remained static over the year at 4.4 per cent.

- Hobart reported the strongest growth in rents, up 3.6 per cent over the past quarter to $453 per week. Over the past year, rents have increased by 5.4 per cent. Hobart also reports the strongest growth over the past month, with a 1.6 per cent increase in weekly rent. Hobart also reported the second highest rental yield (after Darwin) of 5.1 per cent, which remained the same as 12 months ago.

- Darwin has experienced the most significant decline in rent to achieve a median weekly rent of $458. This is down -0.3 per cent over the quarter and -5.7 per cent over the past year. In addition, Darwin also reports a drop of 0.2 per cent over the past month. However, at 6 per cent, Darwin has the highest gross rental yield out of all the capital cities (up 0.1 per cent on the past 12 months).

CoreLogic Research Analyst Cameron Kusher said the first quarter of 2019 had delivered the highest increase in weekly rents since the corresponding first quarter a year ago

“Our regional housing markets are performing marginally better than the capital cities, many of which have been experiencing weaker rental market conditions in recent years due to excess housing supply and growing investor activity,” he said.

“Quarterly rents have increased across all capital cities, bar Sydney and Darwin.

“However, with a median rent of $582 per week, Sydney remains Australia’s most expensive city for tenants by far.”

The Quarterly Rental Review also highlights a national increase in yields over the past three and 12 months.

Gross rental yields for the first quarter are 4.10 per cent compared to 3.95 per cent in the previous quarter and 3.77 per cent a year ago. Darwin has the highest rental yield across the country with an annual median of 6 per cent.

According to the ABS, total household assets were recorded at a value of $12.6 trillion at the end of 2018. Total household assets have fallen in value over both the September and December 2018 quarters taking household wealth -1.6% lower relative to June 2018. While the value of household assets have fallen by -1.6% over the past two quarters, liabilities have increased by 1.5% over the same period to reach $2.4 trillion. As a result of falling assets and rising liabilities, household net worth was recorded at $10.2 trillion, the lowest it has been since September 2017.

Based on this data from the ABS, the Reserve Bank (RBA) calculates a number of household finance ratios.

The first metric detailed from the RBA are the ratios of household and housing debt to disposable income. As at December 2018, household debt was 189.6% of disposable income, a record high and up from 188.7% the previous quarter. Housing debt was also a record high 140.2% of disposable income and had risen from 139.5% the previous quarter.

While debt levels are quite high, the ratios of asset value to disposable income are much higher. While that may be the case, it is important to understand that if asset values fall, the value of the debt typically doesn’t reduce at the same speed, which can lead to asset value erosion. As at December 2018, household assets were 927.9% of disposable incomes. This ratio has declined as property values have fallen, down from a peak of 962.1% in December 2017. Similarly the ratio of housing assets to disposable income is currently 495.3%, down from its peak of 529.7% in December 2017. The 495.3% figure is the lowest it has been since September 2016.

As a result of a reduction in the ratio of assets to disposable income, the ratio of debt to assets is climbing. Total household debt is now 20.4% of household assets, the highest it has been since March 2016. Total housing debt is 28.3% of total housing assets, the highest it has been since September 2014. Again, this reflects the fact that asset values are falling as debt increases.

Despite generational low official interest rates, the measures of interest payments to disposable income have risen over recent quarters. This is likely reflective of lenders lifting interest rates independently of any adjustment to the cash rate by the RBA. Household interest payments represented 9.1% of household disposable income in December 2018, their highest share since September 2013. Housing interest payments accounted for 7.6% of household disposable income in December 2018, their highest share since March 2013. Despite the cash rate tracking at generational lows, households are paying a proportionally higher share of interest than they have in many years.

With housing values falling and expected to keep falling, the ratio of assets to disposable incomes is likely to fall over the coming quarters. Although most households will likely remain in a position whereby the value of their assets is significantly higher than their debt, no doubt an increasing number of recent property purchasers will have higher levels of debt than the value of their asset. This is probably an area of most concern for the RBA. If this leads to reduced consumer expenditure an in-turn slower economic growth it may be a trigger for either lower official interest rates or changes to mortgage lending policies (or both). Furthermore, with household debt at record highs and households dedicating more of their income to servicing their debt at a time when interest rates are so low if household debt levels haven’t declined by the time interest rates rise it could create more challenges for households.

This data will be very important to focus on over the coming quarters.

Linda and Carlos Proudly present 12 Page Street, North Lakes. 4 bedroom 2 bathroom 2LU. #property #management since #brand #new #1999 Near New Curtains and Carpets #Freshwater Stage #School #Catchment #Westfield #Costco #Bunnings #parks #local #amenities $370 per week #available 18th April Call 07 3263 6085 to Inspect. Located in the Freshwater Estate of North Lakes and easy walk to Lake Eden and Westfield’s shopping centre in the heart of North Lakes this Cozy 4 bedroom property features:

- Open Planed kitchen/ dining and family area with ceiling fans and access to the backyard.

- 4 Carpeted bedrooms with built-ins and ceiling fans.

- Master bedroom has a Walk in robe and Ensuite.

- Main bathroom with separate bath and Toilet.

- Double lock up Garage with internal laundry.

***** NEAR NEW CARPET AND CURTAINS*****

http://ljgrealestate.com.au/rental/12-page-street-north-lakes-qld-4509/

PLEASE LIKE OUR FACEBOOK PAGE http://www.facebook.com/ljgrealestate

Best Regards

Linda 姬琳达珍 and Carlos Debello (LREA)

琳达姬琳达珍Debello LREA – LJ Gilland Real Estate Pty Ltd

Request FREE Rental Appraisal here!

“Your Local Property Management & Sales Specialists”

PO BOX 19

ZILLMERE 4034

电话:07 3263 6085

0409 995 578 (L)

LJ吉尔兰房地产有限公司

要求在这里免费租赁评估!

“您的本地物业管理和销售专家”

https://www.ratemyagent.com.au/real-estate-agent/linda-debello/reviews/32-musgrave-st-north-lakes-aail7o

https://www.ratemyagent.com.au/real-estate-agent/linda-debello/reviews/19-eaton-cl-north-lakes-aaj14y

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/41-belmore-street-northgate-aafqu2

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/5-raymont-street-north-lakes-aagq0c

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/12-may-st-mango-hill-aafxwk

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/12-may-st-mango-hill-aag2go

https://www.ratemyagent.com.au/real-estate-agency/lj-gilland-real-estate/property-listings/10-karawatha-st-springwood-abpzj5

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/41-belmore-street-northgate-aafqu2

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/13-narelle-crescent-rochedale-south-aaf3pg

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/3-sunhaven-crescent-kuraby-aafggb

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/16-st-clair-court-redland-bay-aag45d

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/6-greenmeadow-road-mansfield-aafms7

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/11-reynolds-cl-redbank-plains-aafwtr

https://www.ratemyagent.com.au/real-estate-agent/lj-gilland-real-estate/reviews/11-reynolds-cl-redbank-plains-aafu86

http://www.facebook.com/ljgrealestate

htw-month-in-review-april-2019 residential-1 by @GillandDebello #family #finance https://t.co/WrgwhmpfJt via @SlideShare

UNDER CONTRACT IN JUST ONE WEEK!

Best Regards.

Best Regards.

You must be logged in to post a comment.